Alvin's Newsletter: No. 21

Weekly newsletter on what I saw interesting in tech, venture capital and business.

📰 News

Sneakers are everywhere: eBay is on it, announcing that ‘sneaker authentication’ will be coming to its marketplace - a few weeks after GOAT raised $100M round. They are likely trying to address some of the leakage they are seeing at the higher end of the sneaker market. Link

One note here is that this may drive higher margin business for eBay because higher-end sales in the $500+ range are harder to justify on eBay where authenticity was not guaranteed. EBay was likely already capturing a decent portion of the lower-end market, but now has a chance to grab some of the fattier meat.

PayTM following the AliPay model by launching a mini-appstore: AliPay has had huge success by using its extensive reach to be a full-service platform where you can interact with all manner of services. They do this by including ‘mini-apps’ into its own app - something we haven’t seen take-off in the west. PayTM is following that model by launching its own. Link

Paytm is providing listing and distribution of mini-apps from within its app, without any charge. Developers will be able to give a choice of Paytm Wallet, Paytm Payments Bank, UPI, net banking, and card payments to users.

Brietling doing something interesting with crypto: This is interesting because I haven’t seen many luxury brands getting involved in the crypto space, let alone for authenticity. They are issuing digital certificates to allow you to verify the authenticity of your luxury watch. The company enabling it, Arianee, have Audemars Piguet as a member so they got some cred. Standardising it is smart - no point every company coming up with their own mechanism. Seems somewhat novelty at the moment. A lot of great things start that way. Link Link1

Breitling can also add information over time. For instance, you can imagine a timeline of repairs with timestamps so that you can keep track of the whole story. Soon, the brand could also offer insurance products through this new channel.

📚 Reading

Benedict Evans at it again with his excellent articles. This time on what it’s like to lose a monolopy. Not so much lose but as the ‘power’/centre of power shifts away into new areas. The monopoly that you might have - simply ceases to matter. IBM with mainframes, Microsoft with PCs and, we are starting to see Google with search.

The last one is a good example. A decade ago - Google was indispensable to any one and any business. Social, mobile, the explosion of content and fragmentation of distribution has made Google - ‘less needed’.

Ben goes into this and explores the problems of a company trying to avoid becoming less relevant. Link

Rather, the iPhone created such a radical change in every assumption about how you would make a ‘smartphone’ that everyone else had to start again from scratch. It’s important to remember that none of the smartphone companies who’d been building things since the late 1990s - Nokia/Symbian, Palm, RIM and Microsoft - managed the transition. None of the others had anti-trust issues. But, they all had platforms, and just as importantly cultures and assumptions, that were based on the constraints of hardware and networks in 2000, whereas the iPhone was based on what hardware and networks would look like in 2010. The only way to compete was with a totally new platform and totally new assumptions about how it would work, and ‘dump our platform and build an entirely new one’ is always a near-death experience in technology. Failing to make it isn’t about a lack of aggression or execution - it’s that it’s really hard.

Companies can be built in many different ways. The way a company is built - as in, its operating rhythm - has profound implications for every part of that company - from what you are measured on, how rem. is set, how you are supposed to work - and ultimately, how the company goes about being successful. Patrick McKenzie goes into what it has been like working at Stripe. Link

Relentless execution is something of a cliche, but it is a cliche for a reason. Organizations that need to hire a Head of X to start Xing will necessarily pay a multi-month cost to start Xing; you can get a lot done in months. Many organizations will have a culture which says “Why do X in the interim when we don’t know the best practices and will inevitably throw it away?”; they will lose out on months of progress.

The returns to pushing your cadence to faster are everywhere and they compound continuously, for years. Don’t send the email tomorrow. Don’t default to scheduling the meeting for next week. Don’t delay a worthy sprint until after the next quarterly planning exercise. Design control and decisionmaking structures to bias heavily in favor of preserving operating cadence.

Coming up with product ideas/problems. Not necessarily what you should do but at least can understand the different methods at play and how to cover each’s (yes grammatically correct) deficiencies. Link

Different entrepreneurs swear by different ideation methods. But what they all have in common is that they focus on finding problems over ideas.

🦖 Entertaining & Interesting things

The Nobel prize in economics this year went to a couple of Laureates for their work on auction theory. Auctions are pervasive throughout our lives and play a huge part in the efficient movement of goods and capital. Worth understanding to better play the game - especially here in Aus when it comes to houses. Link [Paywall] Link1

Wilson focused on the case where the bidders care only about the “common value” of the house—for example, they’re all flippers who are thinking only about what they can turn around and resell it for. Milgrom looked at a broader set of cases where bidders care about the common value but have differing “private values”—i.e., the house is worth more to one bidder than another, perhaps because it’s closer to where she works. He showed that the seller will get a higher price if more information about the value is available (such as an independent appraisal) and if bidders learn more about each other’s estimated values during bidding (so the agent shouldn’t conduct a “blind” auction).-

The backstory on how some of the most famous comedians you know were discovered - by one guy! Link

Had a call yesterday with the guy who discovered and advised Jon Stewart, Bill Maher, and just about every other famous comedian. He utterly blew my mind with how he guided them early on in their careers to find their “signature move.”

The Waldorf Astoria is a storied hotel. A look inside some of those stories. Link

Roosevelt didn’t want the world to know that he had polio, so he commissioned the Waldorf train station—and a bespoke locomotive—so that he could commute between New York and Washington with ease and privacy. The train’s last car was built to accommodate his presidential limousine; its two, ultra-wide pocket doors allowed his driver to three-point-turn the limo off the train and into a custom elevator leading to the hotel’s garage.

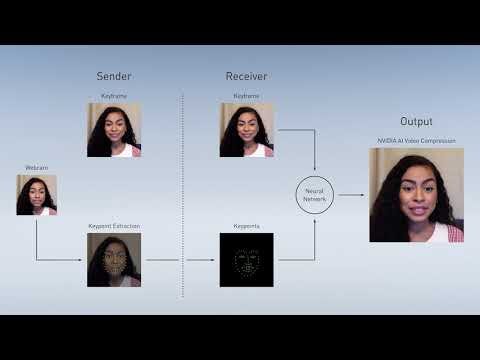

Nvidia show-cased some of their research into alternative forms of video compression using AI - the use-case being for virtual meetings. Looks to be huge bandwidth reductions (10-100x) - although we aren’t exactly bandwidth starved. Could make way for new types of video meetings given all the extra bandwidth available. Below that - on a similar note - someone showed off using AI to remove objects from videos. Astoundingly smart if it can do what he is talking about.

🎧 Podcasts

The best podcast episodes last week according to Bosco Tan:

Oral history of Netscape (Go for Broke) - 30 mins: The “Go for Broke” series profiles the history of the turn-of-the-century dot-com bust. This week covers Netscape, probably the first irrational market exuberance story. The seminal browser company went public and quickly became worth $3 billion, despite having been founded only 16 months before and having never turned a profit. You get the story through interviews with the people that were there. Link

Chamath Palihapitiya on how he thinks (The Knowledge Project) - 86 mins: Chamath has been featured a number of times in this newsletter and indeed the podcast list. He’s often talked about his perspectives and thoughts on other subjects, but this interview is a lot more introspective. He dives into his views on his own happiness, his mental battles and how he thinks about investing. Link

TikTok and its impact on the US election (BBC Documentary Podcast) - 52 mins: A central story of the 2016 US election was the power of social media marketing to sway voter sentiment. In 2020, increasingly TikTok is playing a key role to shape the narrative. In the climate of Trump’s overtures to ban the platform in the US, its content creators are increasingly using the platform to appeal to millennials. Link

US Government sues Google (The Journal) - 16 mins: In amidst the anti-trust hearings, Supreme Court appointment and the lead-up to the US election, US attorney general Bill Barr’s office has filed for a law suit against Google - in particular their “monopolistic” search service. Both the timing and the subject of the law suit seems peculiar. Is this politically motivated prior to the election? Why Google on search and not Amazon on ecommerce or Facebook on social? Link

📹 TikToks

Surgery on a banana. Link

Raiden catching that laser. Link

One of the best movie scenes. Link

Can’t hit the floor. Link

Tarantino doing the Pulp Fiction/Uma Therman/John Travolta dance. Link